- Consumer & Market Trends Newsletter

- Posts

- RETAIL RHYTHM

RETAIL RHYTHM

MAKE YOUR TIMING, OR MISS YOUR SHOT

Step up, founders this is the golden hour for beverage brands, and the reality is, you can’t afford to get cute when it comes to retail timing. Shelf space is as fickle as fashion and twice as expensive. Winning it and keeping it is less about having the most photogenic can and more about knowing which calendar dates are non-negotiable. Here’s the straight-up truth: in beverage, timing is everything. If you’re early, you look like a pro. If you’re late, you look like next year’s afterthought.

Let’s talk about what the best brands actually do and why so many get tripped up before a single bottle hits a shelf.

⚡THE CALENDAR, NOBODY TELLS YOU ABOUT (UNTIL YOU MISS IT)

Every retailer in America runs a to-the-minute clock for beverage resets, reviews, and resets again. These aren’t suggestive guidelines; they are written into the stone tablets of category management. The unlucky majority? They hear about a slot after it’s been filled. The ones with velocity? They already pitched, onboarded, and polished up their POs months ago.

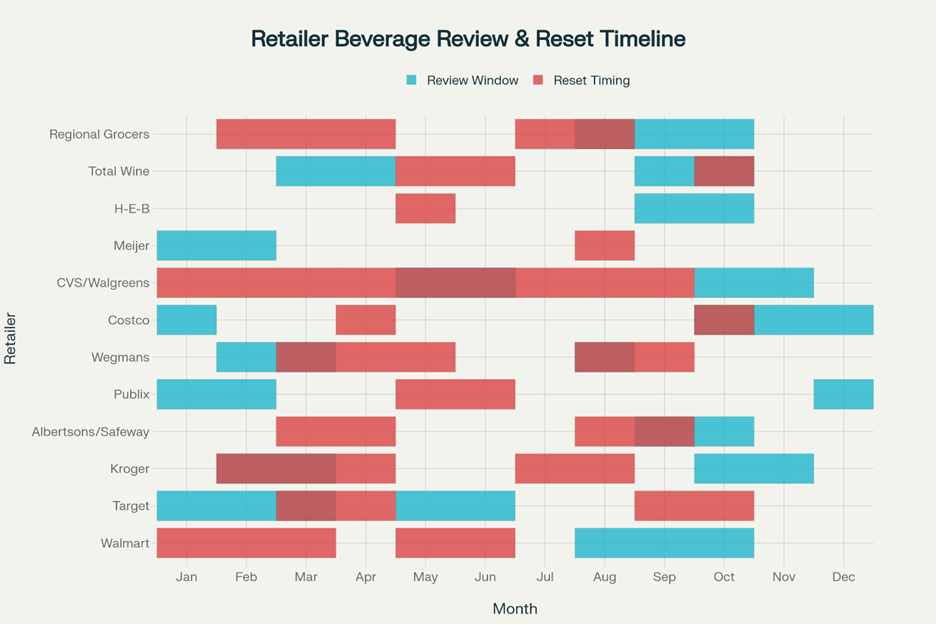

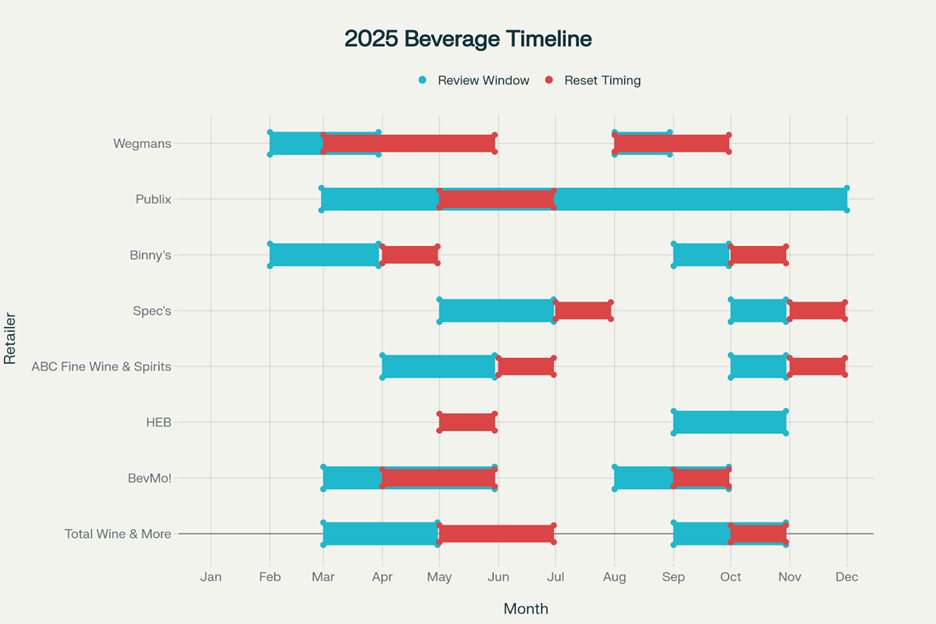

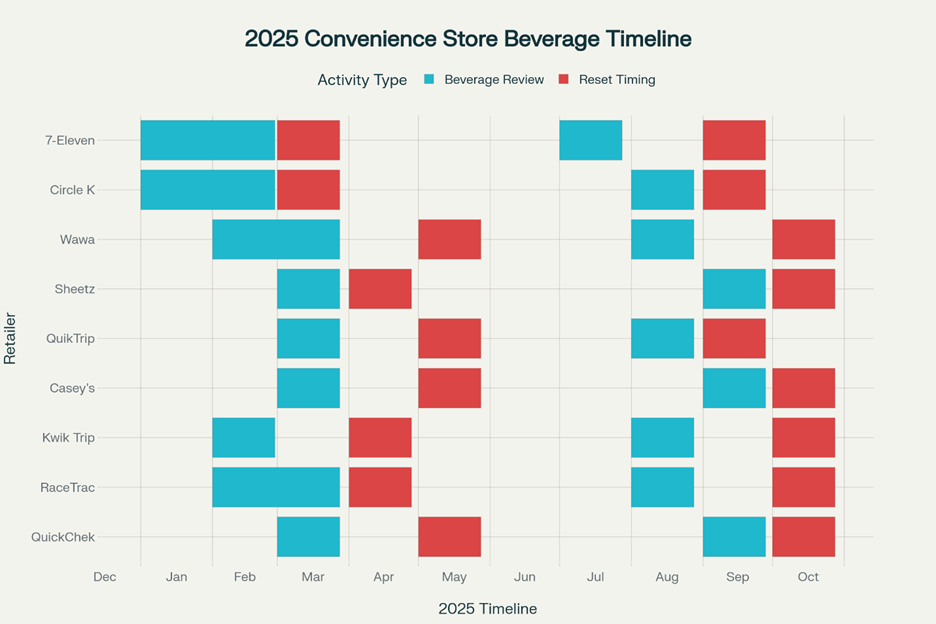

Here’s a practical breakdown:

National & Regional Chain Windows

Regional Chain Windows

Convenience Chain Windows

Here’s the kicker: get your pitch in three to six months before those resets. Miss window? Grab a book and enjoy patience rehab. In retail, lost time is lost dollars and sometimes brand survival.

🚀 CAUTIONARY TALES FROM THE TRENCHES

Did you know nearly 90% of new beverage brands fizzle before hitting $10 million in revenue? It’s brutal math, with most failures stemming from one thing: ignoring the basics that big retailers care about. You see, it isn’t just consumer demand or flavor, it’s boring (but critical) stuff: supply chain hiccups, financial missteps, late submissions, and forgetting that buyers have their own deadlines.marginvelocity+1

Ever heard of that digital-first beverage play that went wild on Instagram but couldn’t deliver on shelf for two months? By the time they sorted supply, their slot had been replaced by a competitor with reliability. Buyers want excitement, but they need certainty even more.

Take the case of early-stage brands who over-invest in branding but under-invest in ops. One startup poured cash into a sponsored influencer blitz, while the warehouse ran dry. No one’s buying what they can’t find, especially not a retailer who gets burned. Worse, if communication is weak, you’re off the shelf before the press release goes live.

Lesson: Don’t be seduced by hype. Quality ops bring home the gold.comesellorhighwater

🏆 THE ART OF PREPARATION: HOW “BORING” WINS

Here’s what winning brands do every time:

1. Reverse-Engineer Your Launch

Get the retailer’s reset week. Start planning backward: when samples and paperwork are due; when distributor onboarding should begin; when marketing needs to hit.

2. Perfect Your Pitch Tools

Build an air-tight deck with real data. Strong photos, ready-to-drink samples, and bulletproof sell sheets are baseline requirements.

3. Trial by Fire

Pitch mock interviews at least five times. Stage tricky buyer questions, logistics curveballs, and nail-down compliance details that can tank a deal.

4. Ditch the Ego, Validate Your Demand

Focus on velocity stories, hero SKUs, and real sales wins. Too many untested flavors and unproven formats dilute your resources, confuse buyers, and drain cash fast.comesellorhighwater

5. Audit Regulatory and Compliance Early

Label claims, TTB filings, UPC codes, and ingredient panels, get these lined up before any pitch. Surprises here are shelf poison.

6. Warm Up Retailer Relationships

Six months before set reviews, make yourself visible. Show up at trade shows, join webinars, connect on LinkedIn, and build rapport. Buyers trust people they’ve “seen around.”

7. Pressure-Test Operations

Make sure your co-packer and distributor can handle scale before the big launch. Late shipments and empty displays are a death sentence.

8. Tune Into Category Needs

Research what’s already on the shelf, what’s been dropped, and what’s gaining momentum. Prove you’re not just another pretty label—you’re the missing piece.

SUCCESS STORIES: WHAT ACTUALLY WORKS

The road to beverage success is paved with vision, timing, and lots of grit. But it’s not just unicorns, founders who follow the retail calendar and make ops their religion keep seeing results:

Zico Coconut Water:

Started as a niche wellness play, Zico broke open the category by obsessing over health-conscious positioning and flexible distribution. They didn’t just roll out to Whole Foods—they expanded to conventional grocers, convenience, and every specialty distributor who believed in hydration as a lifestyle. The kicker? When cash ran thin, they doubled down on strategic trade relationships rather than chasing every influencer dollar. Result: a major acquisition and shelf space everywhere.cascadiafoodbev

Nantucket Nectars:

Two “Toms” piloted their juice blends from a small boat in Nantucket, focusing entirely on authenticity and what local market buyers wanted most. They built buzz with sample drops, delivered every order on time, and fostered legendary customer loyalty. Scaling up meant they mapped their pitch cycle and grew only as their distribution allowed, not faster. Their discipline paid off, leading to regional and then national expansion.cascadiafoodbev

BrüMate and BeatBox:

Modern beverage disruptors who understood the difference between hype and reliability. BrüMate ($144M/year) and BeatBox ($132M/year) didn’t just own the launch moment—they made sure they could fulfill every PO with accuracy and speed. They also hired ex-retail buyers as advisors to sidestep rookie mistakes and understand buyer psychology from day one.starterstory

🤹 ENTERTAINMENT BREAK: HOW TO NOT BE THE “WAITLIST WONDER”

Let’s get real. Every founder has a story about “the one that got away”—that elusive shelf slot, the vodka category reset that seemed tailor-made, or the influencer who promised viral momentum. Truth is, retail is more like pro chess than poker.

Here’s how brands really get bumped to next year…

The Chameleon Founder: Spends more time tweaking his pitch deck graphics than doing ops dry runs. Looks dazzling, until the first retailer asks about inventory turns.

The Reluctant Networker: Shows up when the pitch window opens, misses every pre-brief, and assumes “hey, I’m passionate!” will carry them.

The Eternal Tinkerer: Launches six flavors and three formats with limited funding. Each pitch, the buyer gets a new surprise. But not the kind that wins resets.

The Silent Operator: Has a killer product but forgets to communicate delays. Retailer replaces them with someone who answers emails.

Survival demands preparation and discipline. Nobody awards shelf space to best intentions.

📅 BEVERAGE BRAND PREP CHECKLIST (FOR GAME DAY)

Research retailer review windows; lock them on the calendar.

Map every deliverable backward from retailer set week.

Mock-pitch your story and ops again and again.

Know category launches and innovation cycles. Don’t pitch pumpkin spice in July.

Get compliance, ops, and logistics locked down well before line review.

Cultivate buyers as partners, not gatekeepers.

Focus on velocity and regional wins, not vanity flavors.

Bring backup samples. People will want to taste, not just see.

🧠 RESOURCE LIBRARY: FOR THE LEARNERS AND BUFFS

· BevNET, Brewbound & NOSH 2025 Content Calendar

https://win.bevnet.com/content-calendar

· WSET Drinks Calendar: Industry Celebrations

https://www.wsetglobal.com/knowledge-centre/blog/2024/the-2025-drinks-calendar

· SPINS Best Practices for CPG Pitch Slams

https://www.spins.com/resources/report/best-practices-for-cpg-pitch-slams/

· NCG Co-op Category Review Schedules (2025 PDF)

https://partnerconnection.ncg.coop/download/file/2025%20NCG%20Category%20Review%20Calendar.xlsx

· Social Nature How to Pitch to Retail Buyers for CPG Brands

https://business.socialnature.com/how-to-pitch-to-retail-buyers-for-cpg-brands/

· NielsenIQ Consumer & Category Trends: Key Growth Strategies for Emerging Beverage Alcohol Brands

https://nielseniq.com/global/en/insights/education/2023/key-growth-strategies-for-emerging-beverage-alcohol-brands/

· Brew Movers Beverage Marketing Blueprint

https://brewmovers.com/blog/beverage-advertising-and-marketing-strategies/

· Crew Marketing Partners U.S. Holiday Planning for CPG Brands

https://www.crewmarketingpartners.com/insights/u-s-holiday-planning-for-cpg-brands-when-to-brief-pitch-and-launch/

· Numerator Beverage Behaviors: 2025 Trends

https://www.numerator.com/resources/blog/beverage-trends/

· Starter Story 16 Beverage Company Success Stories

https://www.starterstory.com/ideas/beverage-company/success-stories

· Come Sell or High Water Why Early-Stage CPG Brands Fail (and How to Avoid the Trap)

https://comesellorhighwater.com/2025/09/18/why-early-stage-cpg-brands-fail-and-how-to-avoid-the-trap/

🔥 CLOSING THOUGHTS

In today’s wild beverage industry, timing is both sword and shield. No one’s giving out shelf space for dreams or taste alone. The brands that win operate with military discipline, they prep for every pitch like it’s the Super Bowl; they schedule every move on the reset calendar and treat every retailer like a true partner, not just a channel.

Remember: if you want to lead, don’t just bring flavor. Bring flawless ops, a bulletproof calendar, and the unwavering energy to follow through 52 weeks a year.

Drink up the hard lessons, memorize your retailer’s set dates, and go build the next beverage legend. All the best battles are won by those who play the long game and play it on time.