- Consumer & Market Trends Newsletter

- Posts

- Behind the Bottle

Behind the Bottle

How Liquor Sales & Distribution Work

Welcome to this edition of our industry newsletter, where we pull back the curtain on the backend of liquor sales and distribution. Whether you're a producer, distributor, or supplier, understanding the mechanics of this complex system is crucial for success in today's rapidly evolving market.

How Liquor Sales & Distribution Work: The Basics

The journey of your favorite spirit from distillery to your glass involves several key stages:

Production

Alcohol is produced by distilleries, breweries, or wineries using raw materials like barley, grapes, or sugar3. This process varies greatly depending on the type of spirit, with whiskey requiring aging in barrels for years, while vodka can be ready much more quickly.

Import/Export

For international products, importers and exporters handle customs, compliance, and logistics1. This involves navigating complex international trade regulations, securing proper licensing, and ensuring products meet requirements for each target market.

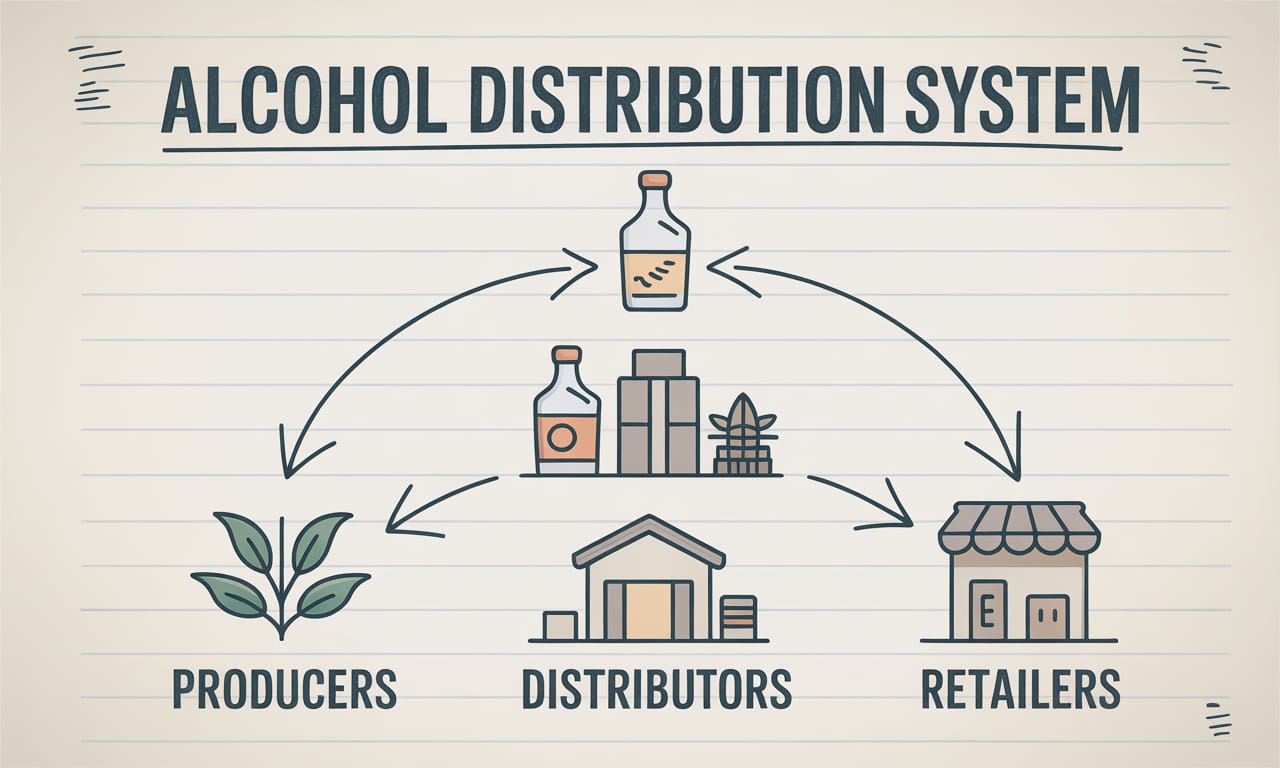

Wholesaling/Distribution

Distributors purchase in bulk from producers or importers. In the U.S., the three-tier system requires that producers sell only to distributors, who then sell to retailers2. These distributors maintain extensive warehousing operations, delivery fleets, and sales teams.

Retail

Retailers (liquor stores, bars, restaurants, online shops) purchase from distributors and sell to consumers1. Each retail channel has unique requirements—from staff training on cocktail preparation to effective merchandising strategies.

Marketing & Brand Building

Throughout the distribution chain, marketing plays a crucial role in building brand awareness and driving consumer demand. This includes bottle design, package innovation, digital campaigns, event sponsorships, and tasting experiences.

Compliance & Regulation

At every stage, strict regulatory compliance is essential. This includes licensing, taxation, advertising restrictions, age verification processes, and reporting requirements that vary significantly between jurisdictions.

Understanding how these components work together is critical for anyone in the industry. The system balances regulatory needs, business interests, and consumer access, while ensuring tax collection and promoting responsible consumption.

Key Facts About the Backend

Three-Tier System

This is the backbone of U.S. alcohol distribution, separating producers, distributors, and retailers to prevent monopolies and ensure tax collection2.

Distributor Revenue Streams

Sales commissions (percentage of wholesale price)

Distribution fees (warehousing, transport)

Volume discounts from suppliers

Value-added services (inventory management, analytics)1

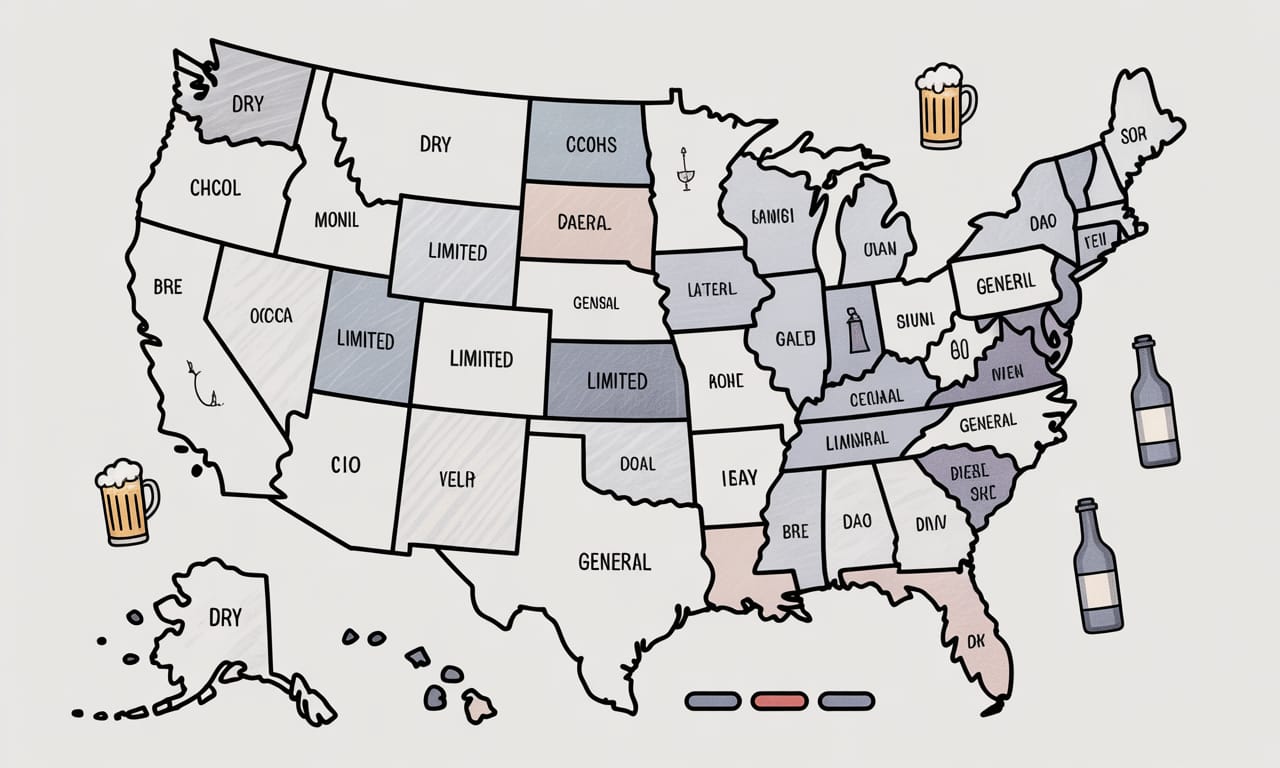

State-by-State Differences

Some states run their own distribution or retail operations, while others allow private businesses to handle all tiers2.

Major Industry Players

The alcohol value chain includes raw material suppliers, producers, distributors, and vendors (on-premise and off-premise)3.

What's Happening Now?

Consumer Preferences Are Shifting

The explosive growth in ready-to-drink (RTD) spirits and non-alcoholic alternatives is reshaping traditional category boundaries. RTDs alone surged 30.4% year-over-year in 2023, signaling a fundamental shift in how consumers access and enjoy spirits5.

Distributor Consolidation

Facing increasingly fragmented consumer preferences, distributors are strategically consolidating to expand their product portfolios and achieve operational efficiencies. This consolidation trend allows them to better serve both emerging brands and established players5.

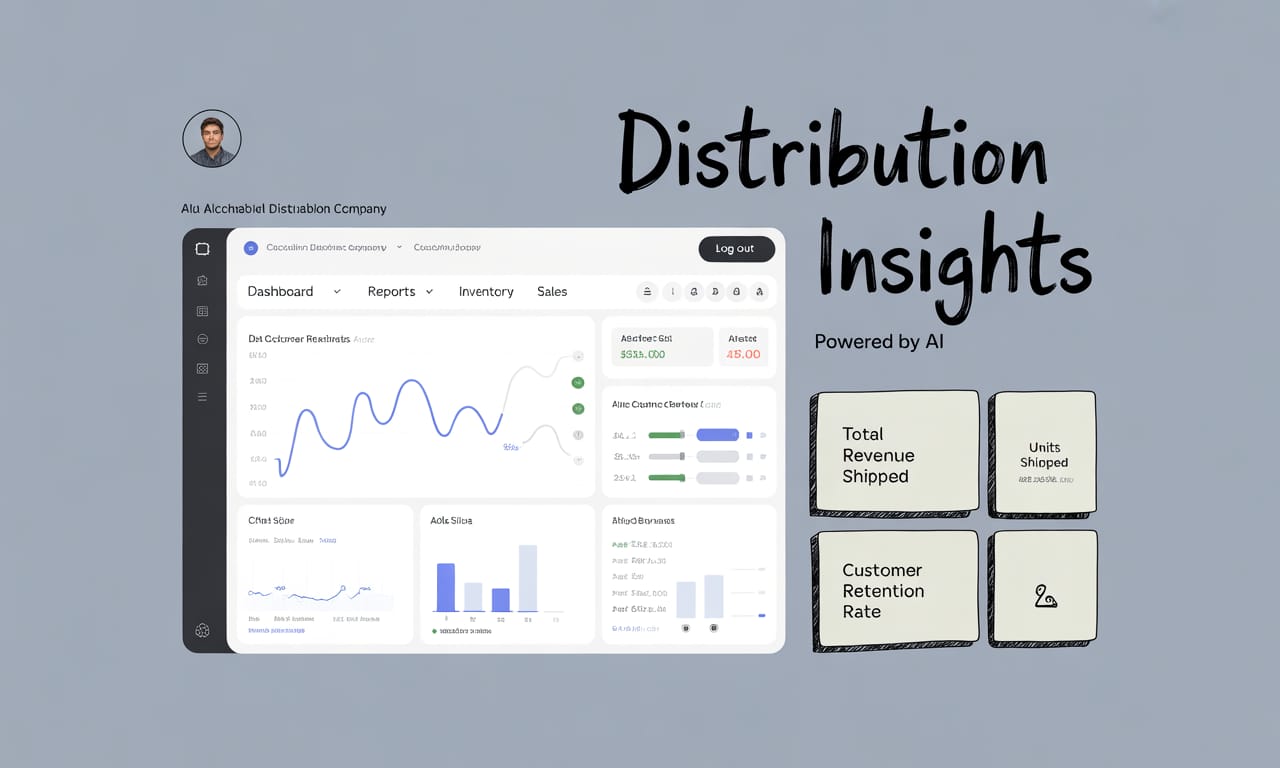

Tech Transformation

Advanced technologies including AI, blockchain, and IoT are revolutionizing supply chain visibility and efficiency. These innovations enable real-time inventory tracking, predictive analytics, and seamless e-commerce integration, fundamentally transforming how products move from production to consumption6.

Pandemic Impact

The COVID-19 pandemic triggered unprecedented spikes in off-premises (retail) sales, creating new consumption patterns and distribution challenges. While these sales have since recalibrated as on-premise venues (bars/restaurants) recover, the lasting impacts on consumer behavior and distribution strategies remain significant5.

The Future of Liquor Sales & Distribution

The alcohol industry is evolving through digital transformation, advanced analytics, environmental initiatives, and potential regulatory changes that will reshape distribution channels and create new opportunities for innovation across the entire value chain.

Digital Transformation

Digitalization

Digital Transformation

Expect more online sales, direct-to-consumer models (where legal), and digital marketing for spirits6. Virtual tastings, augmented reality experiences, and mobile apps are streamlining operations while blockchain emerges as a solution for supply chain transparency. Leading brands have already seen 300% increases in engagement through AR label experiences, and over 60% of distributors now utilize integrated mobile apps for inventory management. Digital platforms that connect small producers directly with retailers are growing at 25% annually in states where regulations permit such arrangements.

Advanced Analytics Revolution

Data-Driven Decisions

AI and machine learning optimize logistics, demand forecasting, and customer engagement6. Predictive analytics anticipate market trends, while deep learning algorithms analyze consumer patterns for hyper-personalized marketing strategies. Distributors implementing AI-driven route optimization have reported fuel savings of up to 15% and delivery time reductions of 22%. Customer data platforms now integrate point-of-sale information with social media engagement metrics to create comprehensive consumer profiles, allowing distributors to recommend products with 35% higher sell-through rates to their retail partners. Real-time analytics dashboards provide distributors with crucial insights during peak seasons, enabling dynamic inventory allocation across markets.

Environmental Initiatives

Sustainability

Pressure is mounting for eco-friendly packaging and greener supply chains. Companies are investing in lightweight bottles, biodegradable alternatives, renewable energy in distribution centers, and electric delivery fleets, with carbon footprint tracking becoming standard practice. Major distributors have committed to carbon neutrality by 2030, with intermediate goals of 50% emissions reduction by 2025. Recycled glass content in bottles has increased from an industry average of 25% to over 70% in premium segments, while shipping weight reductions of 40% have been achieved through innovative bottle designs. Beyond packaging, water conservation in production and distribution facilities has become a key performance indicator, with industry leaders achieving 30% reductions in water usage through advanced recycling systems and process optimization.

Regulatory Landscape Changes

Regulatory Evolution

Some states may relax the three-tier system, especially for small producers and online sales channels2. Interstate shipping regulations continue to evolve while digital age verification technologies enable more secure online transactions. Twenty-three states now offer limited direct-to-consumer shipping allowances for distilled spirits, with another seven states considering similar legislation in upcoming sessions. Compliance technology platforms have emerged as critical infrastructure, with investment in regulatory tech (RegTech) for alcohol increasing by 85% since 2020. Self-distribution caps for craft producers have been raised in twelve states, creating hybrid models that maintain regulatory oversight while providing greater market access for small brands. The pandemic accelerated permanent to-go cocktail laws in over 30 states, creating new distribution challenges and opportunities.

Emerging Market Trends

Premium and super-premium spirits categories are reshaping distribution priorities. "Better for you" products with functional ingredients and lower alcohol content gain market share, while craft spirits challenge traditional distribution with authenticity and local production. The premium-plus segments now represent over 37% of spirits value despite accounting for only 22% of volume, driving distributors to allocate more resources to these higher-margin products. Ready-to-drink cocktails have sustained 28% compound annual growth since 2019, requiring distributors to develop specialized merchandising strategies that bridge traditional category divides. Non-alcoholic spirits alternatives have exploded with 120% year-over-year growth, creating new placement challenges for distributors working with retailers. Cultural diversity in product offerings has expanded dramatically, with tequila and mezcal leading growth at 17% annually, followed by Asian spirits like baijiu and soju entering mainstream distribution channels.

Global Supply Chain Resilience

Distributors are diversifying supplier networks, maintaining higher safety stock levels, and implementing advanced scenario planning. Many explore regionalization strategies to reduce vulnerability, while technology enables visibility across the entire supply network. After pandemic-related shortages affected 63% of global spirit brands, distributors have increased safety stock levels by an average of 40% for essential products. Multi-sourcing strategies have been implemented for critical inputs like glass and specialized closures, with 78% of major distributors now requiring suppliers to maintain secondary manufacturing capabilities. Warehouse automation investments have increased 215% since 2020, with robotics handling 40% of case picking in next-generation distribution centers. Real-time tracking from production through delivery is now standard for premium products, with specialized sensors monitoring temperature, shock, and tampering throughout the journey from distillery to consumer.

Opinion: The Three-Tier System-Barrier or Backbone?

When examining the three-tier system more closely, the complexity of its impact on the modern alcohol industry becomes evident. Established in the aftermath of Prohibition, this regulatory framework was designed to prevent the vertical integration that had led to aggressive sales practices and public health concerns. By separating producers, distributors, and retailers, regulators created a system of checks and balances that has undeniably contributed to market stability for decades.

For craft distillers and small producers, however, the system presents significant hurdles. The mandatory involvement of distributors—who often prioritize high-volume, established brands—creates a substantial barrier to entry. Many talented distillers with exceptional products struggle to gain market visibility simply because they cannot secure distribution partnerships. This bottleneck effect has arguably limited consumer choice and innovation in an industry otherwise ripe with creativity.

Advocates for the system point to its effectiveness in ensuring product safety and regulatory compliance. Distributors serve as crucial verification points, ensuring that products meet quality standards and that alcohol sales generate appropriate tax revenue. They also facilitate efficient recall processes when necessary, providing an important layer of consumer protection that might be compromised in a less regulated environment.

The COVID-19 pandemic exposed both the strengths and weaknesses of the current system. When on-premise venues shut down, the established distribution networks proved remarkably adaptable, quickly redirecting supply chains to retail outlets. Simultaneously, the crisis highlighted the system's limitations, as producers restricted to traditional channels struggled while those with direct-to-consumer capabilities thrived.

Looking forward, the most promising path appears to be strategic modernization rather than wholesale dismantling. Some states have already implemented hybrid approaches, allowing limited direct shipping for small producers while maintaining the core three-tier structure. These experiments in regulatory innovation could serve as valuable models for national evolution.

The digital transformation sweeping through other industries will inevitably continue to challenge traditional alcohol distribution models. E-commerce platforms, subscription services, and digital marketplaces are creating consumer expectations that the current system struggles to meet. Yet, technology can also enhance the existing framework—improving transparency, streamlining compliance, and creating new opportunities for collaboration between tiers.

Ultimately, the question isn't whether the three-tier system should exist, but how it should evolve. The stakeholders who will thrive in tomorrow's marketplace will be those who embrace change while respecting the fundamental protections that regulation provides. By fostering dialogue between producers, distributors, retailers, regulators, and consumers, the industry can develop a modernized framework that balances innovation with responsibility, market access with public health, and commercial interests with community well-being.

Resources for Suppliers

TIPS Alcohol Safety Training Courses on responsible sales and compliance for industry professionals. These programs cover identification verification, intervention techniques, and legal requirements across different jurisdictions1.

Industry Associations

National Alcohol Beverage Control Association (NABCA) - Offers research, data, and advocacy for control state systems

Distilled Spirits Council of the United States (DISCUS) - Provides regulatory guidance and industry standards

Wine & Spirits Wholesalers of America (WSWA) - Represents distributors with educational resources and networking opportunities

Brewers Association - Supports craft brewers with technical resources and market development

Regulatory Resources

TTB (Alcohol and Tobacco Tax and Trade Bureau) - Essential for federal permits and label approvals

State ABC (Alcoholic Beverage Control) boards - Navigate state-specific regulations and licensing

Technology Partners Explore platforms offering inventory management, analytics, and digital marketing solutions tailored to the beverage alcohol industry. These technologies can streamline operations, enhance compliance tracking, and improve market visibility6.

Trade Shows & Events Attend industry expos to network and stay updated on trends. Key events include WSWA Convention, NABCA Annual Conference, and regional craft beverage shows1.

Compliance Solutions Software platforms and consulting services specialized in navigating the complex regulatory landscape of multi-state distribution.

Market Research & Data Access industry reports from Nielsen, IRI, and BevAlc Insights to inform strategic planning and identify emerging consumer trends.

Educational Webinars Many industry organizations offer free or low-cost educational content covering distribution strategies, regulatory updates, and market trends.

Looking for Distribution and Customer Support Click Here.

Quick Reference: How Alcohol Gets to Market

Stage | Key Players | Main Activities |

Production | Distilleries, Breweries | Brewing, distilling, bottling |

Import/Export | Importers, Exporters | Compliance, logistics, customs |

Distribution | Wholesalers, Distributors | Warehousing, transport, marketing |

Retail | Stores, Bars, Restaurants | Sales to consumers |

Sources Used

Images are for illustrative purposes and sourced from Unsplash.

Stay tuned for our next issue, where we'll dive deeper into digital marketing strategies for beverage brands!